Sunday, October 30, 2016

Find the weakness of your Strategy

As i have continue my learning on forex I found out that there is no holy grail strategy. Every strategy has a witness and if you combine 1 strategy to another you will end up loosing more than earning. I could not lay all the details on this since my type of strategy might not work in you. But what i could share is when times hardship comes that no matter how good you prepare your trade plan if market is not with you then learn to stop pushing. You have to find your way back. Don't try to overdo it. I dont know how you are going to do this. to be back on track but find ways that you will be inspired again. See im writing this to document currently what im feeling. But i know as soon ill pass this through there will be something good. Now I understand why 90% fail on this kind work, its because on situation that pulls them back.

In my case there will always be somebody close to me is waiting for me to fail. Believe me even my father want to see me fail. Its not because they hated me its just they are angry for what ever reason, valid or not. My point here is situation is situation and theres nothing you can do about it. But Future it can be re-write. Its in my hands if ill go with the flow of strong current of negativity and end up same as always or Ill have to stand my ground continue to pursue learn to lean back and fight another day...

Cyril this is your choice go fight the war you may loose a lot of battles but you will win the WAR!!!!

Tuesday, October 25, 2016

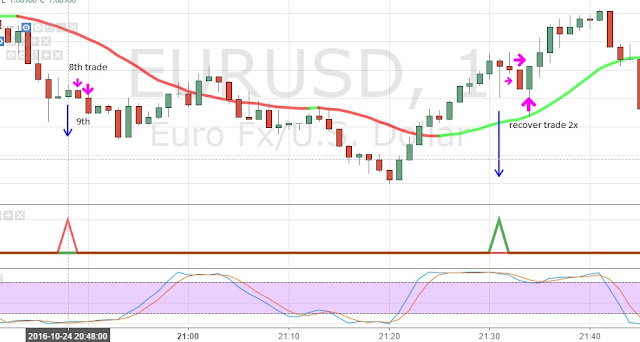

Binary Option Oct 24 Result

1st Trade

2nd trade

3rd trade

4rth to 7nth trade

8th to 10nth trade

11nth to the last trade for the day

Paitience is Bitter but its fruit is sweet

Consolidation on 4hrs chart - Meaning there will be a coming big trend, Scalping strategy is good on this point using Moving average strategy however i prefer trading on Binary Option also

Trends (50sma)

1 Day = down

4hrs = In between

1hr = about to go up (possible to go down is big)

Laying the Potential pips is easy but getting it needs skill!!!

Sunday, October 23, 2016

Trade Plan October 24

Things to consider on this trade plan

1. stochistics 4hrs not yet fully pointing up

2. Stochistics 1hr already on the over bought zone possibility to go down is high

3. resistance both 4hrs and 1 hr if this will not hold trade on the green area

4. Trend it is still down trend so better lesser your trade value and always have a trailing stop. 5273105 rule will be best for safety

5. Dig Dip on Fundamental.

Friday, October 21, 2016

Never Go against the trend

Unless you are not an expert swing trader, a trader that can trade both Up and down regardless of Market trend may i strongly suggest you trade on trend

For me to find out current market trend on different time frame (time frame topic click me) I use 200 SMA and 50 SMA. the question is why 200 and why 50 - pls search that on google you will have tons of reasons. this are the most common used and proven calculation on Moving Average.

When ever i go against the trend i make sure i have a stong dip data research on fundamental which I will believe that this could really change trend. However the bad side on this is currently I have difficulty setting up the the stop lost (need to improve more on my skill in this one)

Video below is my trade plan and i use the trend to my favor thats why im waiting for this to go up both 4hrs chart and 1 hr before ill find my entry point in 5min chart in going down. see the video for detail explanation

For me to find out current market trend on different time frame (time frame topic click me) I use 200 SMA and 50 SMA. the question is why 200 and why 50 - pls search that on google you will have tons of reasons. this are the most common used and proven calculation on Moving Average.

When ever i go against the trend i make sure i have a stong dip data research on fundamental which I will believe that this could really change trend. However the bad side on this is currently I have difficulty setting up the the stop lost (need to improve more on my skill in this one)

Video below is my trade plan and i use the trend to my favor thats why im waiting for this to go up both 4hrs chart and 1 hr before ill find my entry point in 5min chart in going down. see the video for detail explanation

Time Frame and its importance

Every time frame have its relationship, if ever you are looking for direction better look on different time frame. Point of entry time frame must be seriously considered. For it will tell you where exactly market is going. Relationship between them will give you better analysis and avoid common mistake like setting up stop lost.

Multiple time frame can also be used in different indicator or strategy on the video below i explain 4hrs time frame and 1 hr time frame which answer the question why does market go down even my 1hr time frame stochistic points up.

Multiple time frame can also be used in different indicator or strategy on the video below i explain 4hrs time frame and 1 hr time frame which answer the question why does market go down even my 1hr time frame stochistic points up.

Why Trading is a skill not Gambling?

Believe me the technicality is the easiest part of trading. Reading of charts can be done even by my friend in 10 days. Creating a trade plan is just the baby steps. Laying down the number of potential pips is easy. Yet the ability to take the pips, the ability gather pips risking small amount is something need to be Practice. and that my friend is call SKILL. building skill takes time. confident on your strategy takes time. the ability to think straight given the situation and other harmful stimulus takes time. Right attitude even when all physical odds is against you is SKILL. You only loose here if you give up. Keep practicing, improve your strategy LEARN, DEVELOP and dont Give up.

this is the reason why they say only 90% is successful in trading. often times its not about the market but about your current situation. Damn mapuputulan na ako ng koriente pag di pa ako kumita...

Wednesday, October 19, 2016

Gawa tayo ng PUKOT!

Pukot bisya term of fish net. I could not consider my self an expert nor a guro. I dont even claim my self as one of it. Slow learner po ako and ang personality ko is bago matoto dapat masaktan muna. The reason my forecast is profitable because I create a pukot on it. laying the fishnet and wait for fish to come. In trading, benefits on this is you can calculate your looses because you have a trade plan. The type of pukot is also important kaya minsan malaki kita minsan maliit noon nong hindi pa ako marunong gumamit ng pukot madalas wala akong nakukuha. And to tell you frankly ilang beses na rin ako na wipe out. So what is your assurance that you will profit on my pukot?? because i have been consistent on LEARNING, DEVELOPING, IMPROVING my skills and that explain my correct market analysis. Im not an expert I commit mistakes but DAMN ive been doing this for 10months now!!!!. Consistency is the key. Have a right attitude.

Market Movement + Pukot = big results here is my trade plan for this day

Market Movement + Pukot = big results here is my trade plan for this day

Tuesday, October 18, 2016

Where did 160 Pips Go?

On my early stage of reading the charts, I always chase the market. and often time it frustrate me. The problem with chasing is by the time you place your trade, is the time the market will go against you. believe me i have done this a lot of time. For this reason I found it favorable to make a trade plan and if market is against you at least from the very start it had happen. That will give you plenty of room to create another plan.

Video below is the exact visual explanation on what im talking about.

Video below is the exact visual explanation on what im talking about.

Monday, October 17, 2016

Potential 160 Pips swing trade

i am opening this trade to the public meaning if you think my analysis is favorable and the potential to profit is high then probably its you that i need.

My plan is to trade 1 - 2 dollars per pip

My Need is just $200 Dollars

profit will be 50/50

The risk will $60 to $70 Dollars but if my market analysis is right the profit will be 160 pips x $2 = $320 less broker commissions

Time frame will be 1 week

Day start 8pm tomorow after fundamental end on Friday Oct 21 before market close we will withdraw.

Requirements:

1. YOU ARE aware that your $200 have a potential to loose $60 - $70 dollars.

2. you are not solicited but its your own free will to take the risk there fore if my analysis is wrong then You can not force me to pay you. however if I am correct then you will get your capital $200 dollars plus the 50% profit

3. Understand the Forex trading risk and potential

interested pm me first before sending money.

if you dont agree then pls ignore this.

Saturday, October 15, 2016

FEAR

This is what i get when not paying attention on trading psychology topics. "kaka sigurista ko eto konti lang na profit ko". Fear was the contributing factor why i earn only 21 pips in which i should have earned 78 pips. as you all could see I do have a working trade plan yet fear cripples me. The result is devastating. i should have earned 57 pips more.

Lets do the math given we trade $5 dollars per pip

trade plan result = 78 pips

78 x 5 = $390 (this is supposed i should earn)

Actual pips earned = 21 pips

21 x 5 = $105

Actual Dollars earned

21 x $0.10 = $2 (this is the reason Im selecting potential Investors (click for details))

Thursday, October 13, 2016

What trader are you? Swing type or Scalp type

Im gonna use 2 type of trading for today. Why Swing?? On Daily Time frame I could see Potential over sell on RSI plus given the factor that it has a potential bounce on the previous lowest low point. However of course need also to anticipate the breakthrough for this. Now, after the Retails sails if price bounce then its time for me to take trade. currently im on the pull back that has potential 60 pips if ever market price is not on my side I have prepare the other type of trading strategy which is the SCALP. basically this trade gonna get 15pips per trade depends if the market will not cut of my 52751310 rule.

What is Swing?

What is Scalp?

video and explanation will be attached after i am done with my current trade.

Swing pic

Scalp Pic

Binary Option

Binary Option = Broker IQ option

5 Min Chart used

1 Min Chart used

Graphing tools

Stochistic

RSI

Boilenger

RSI = give signal to prepare for trade

Stochistics = identify point of entry (upon crossover)

Boilenger = incase loose trade this will guide me to take trade again

In case i loose on my first trade i double my trade value on the next candle (correction)

due to limited funds i could only trade 1 correction.

Important

Only trade IQ option broker when the market in US Open that usually starts at 9PM. this will give you 87% return profit. If you have slow connection better not trade you will have a problem in placing your trade. often latency and un-allowed trade occur, which is bad on correction trade strategy

Timing is the key in binary. pls dont be greedy limit your trade to 8 to 10 trades.

My door is open on to investor who would like to take a risk. I only start at $10 dollars which limits myself to earn more. pm me if you are interested

Wednesday, October 12, 2016

How to forecast Possible direction and Number of pips to profit

Every one of us may see a pattern in every chart thats why we need to practice to identify support and resistance. The key is by changing time frame from 1week to 1 day, 4 hours and 1 hour . It is important that you could see on your naked eye certain bounce of the price. and as you look back you could see another bounce back of price. From there you could connect a line with it. By practicing to see the obvious on chart, there you could forecast possible direction.

(dont worry if you dont figure it out yet, like me i could not identify this connecting lines when i first started)

On the video below is a detail example in forecasting possible direction and identify number of pips you could get.

To know Direction I use diagonal support and resistance

To identify possible change of direction i use horizontal support and resistance confirm by pivot

To know number of pips again i use Horizontal Support and resistance

To identify stop loss i look on previous high or previous Low

To identify specific Take profit I use Fibonacci or Pivot

I cant tell you how you must trade, however i can give you guide thats based on my personality how i identify profitable trade. on the video below is the best example on what i am talking about

Remember trade plan is to prepare yourself to trade but to take a trade and identify specific point of entry is in another video. Below video is more in charting, to create guide for you. It is important to create trade plan before you make a move to trade.

Tuesday, October 11, 2016

90 pips goal for 1 week, reach in just 2 days

This was my 1 week trade plan which obviously market is on our side that it reach our goal in just 2 days. Now its time for me to evaluate my chart identify new support and resistance and consider market mover fundamentals. the obvious next trade for this is going up however the week end fundamental whichi believe have strong impact on this. For this reason I need to prepare also the possible breakout of my current support.

As always if this happen i have to wait for pull back before i make a trade posting later my trade plan for this week end...

Result of the Trade plan created Oct 9

My Goal for the week is 90 pips which divided in to 2 trade. First trade is to get the 50pips which you could see that the market is on our side it has given already the pips we forecast. however my actual trade is only 11pips. What went wrong??? doubted my trade plan that created so i stop my trade early plus i do have things to take care that i need to detached to my laptop and not to mention I almost hit a kitten on the road on my way home.

Currently i just open another trade which is the remaining 40 pips in second trade plan. confident level is high due to the yearly pivot that did not hold. Im trading down with the tp of only 25 pips. I decide to re-evaluate my chart for the reason i have hit my 1st trade goal.

Sunday, October 9, 2016

90 Pips trade plan 1 week time frame

Considering Fundamentals that are market movers

1. Initial Jobless Claims USD (no forecast yet)

2. FOMC (meeting)

3. Retail Sales (Positive forecast)

The effect of UK leaving EU union I believe have great impact on this one. although election is near on US the technical analysis always give first clue of where market will go. for this reason I also need to prepare the possibilities that my current analysis will not go as my trade plan that is why my stop loss is strict and must be implemented. However due to what is showing i need to wait for the market to bounce back before i start to trade. which you could see on the graph.

for better understanding strongly suggest to watch this video

Result of this Plan delivered 90 pips (click to see result)

Thursday, October 6, 2016

2 trade Setup 1 currency

1st Trade Setup is the favorite head and shoulder pattern with a promising profit of 50pips more or less. the wnd trade setup is the pull back using fibonacci tool to identify take profit position.. for the stop lost be specific not to break the highest position coz if it does then the trand is still to go up.

To confirm our position lets wait for our stochistic RSI to be overbought. in which i specifically mark on the pic above the start trade. Again once we have this confirmation then its time to go for 5min chart to identify point of entry. Why 5min to minimize looses. but not compromise position.

for eurusd update last night it consilidated in which i took an error and loose $4 dollars. another lesson learn to follow trade plan

click video bellow to exactly show my explanation

2 trade plan setup 1 currency pair

Wednesday, October 5, 2016

Oct 5 Eur usd trade Plan

After ploting the support and Resistance, I have anticipate the Lowest of low hoping to see highest low to confirm that the trend will go up however I also anticipate to see even Low point or even lowest of the low point. what ever market will give ill gonna make trade on Buy setup.

Importance on this plan is the Flexibility to always allow the possibility to happen. in which what ever the market give as long it is inside the range of our support and resistance then we still have a profitable trade. to better understand what im talking watch the video

Flexible trade plan Oct 5

With in a week created 4 different Plan of trade all are successful

Using pull back strategy and defining Point of entry in 5min chart

First Pic

Second Pic

Third Pic

4rth Pic

First Pic

Second Pic

Third Pic

4rth Pic

Tuesday, October 4, 2016

Head and Shoulder Pattern

Currently on 4hrs chart of Aud/Usd chart a head and shoulder potential pattern have started. since i miss the first point of entry i am now watching it closely so that i could get a point of entry that will not give me lot of pips to risk.

My signal that i do have a point of entry is if the blue cross over the red of my stochrsi indicator or there will be over bought thats its time to sell it. so what ever be the signal that comes ill now pick a specific point of entry on 5 min chart. in which we all know I pick the overbought or obersold which my indicator will be boilenger and stoch Rsi..

Good luck guys if you need to look on the video my explanation of the potential head and shoulder pattern pls click the title below.

Oh by the way potential pips will be around 70-75 pips again do the math to how much we are going to earn .

Head and shoulder Pattern

Sunday, October 2, 2016

Wait for pull back then take trade

We already have plan based on 1hr chart to trade down with the target of 54pips and currently what we are doing is to find point of entry on 5min chart which this is what we are waiting if market will go on where we want their position will be then we make trade . However be prepare of sudden changes so better look closely on highest of high and lowest of low both 5min and 1 hr chart

AUDUSD pair trade short 54pips target

AudUsd Go short 54pips by alphasurecadet on TradingView.com

For my exact point of entry Ill wait for market to open on Monday then again im gonna get my point of entry on 5min chart making sure stoch Rsi are on crossover and point down. It is really good to wait due to the slipage that might occur on weekends.

|

| 54 Pips target |

Subscribe to:

Comments (Atom)