Currency Strength 1hours

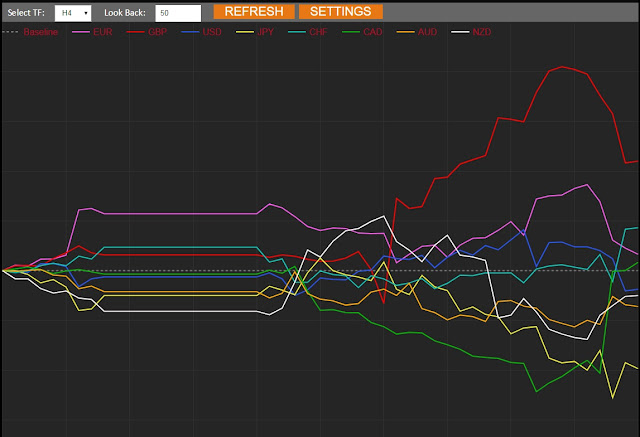

Currency Strength 4hrss

EurJpy 4hrs

Euro is strong

Jpy weakest

EurJpy 1hr

Euro is weak below zero

Jpy Weakest

Beautiful pattern have seen in 1hr so trade will be based on 1hr reminder that trend is going up so be cautious on trading down. to trade up it should bounce on the red bar which is the strong support

=========================================================

EurCad 4hr

Eur strong Violet about to cross Cad Grean

EurCad 1hr

Eur weak below zero

Cad Strongest

Currency strength and chart are going in same direction currently Euro is still strong but is about to get weaker. I have seen divergent on this chart so there will be a strong pull back to change the trend

which can form to a head and shoulder pattern. For the right shoulder there are 2 keys position to closely monitor.

--------------------------------------------------------------------------------------------------

UsdCad

Cad has just intersect on 4hrs time frame which Cad get stronger above 0 while Usd is just below 0

Cad Strongest in 1hr time frame while Usd 3rd to the weakest currency

The favorable trade will be down however it has already started going down very strong which break the 200MA we will be looking for a retest or pullback. pull back is going to expect above .382 and .618 . so the key factor on this chart is the

1. red box support

.382 Fibonacci

.618 Fibonacci

Pattern is forming Head and shouler

==============================================================

Need to compare this to other trader and find out if they have seen what i have seen on this cart.

EurCad 4hr

Eur strong Violet about to cross Cad Grean

EurCad 1hr

Eur weak below zero

Cad Strongest

Currency strength and chart are going in same direction currently Euro is still strong but is about to get weaker. I have seen divergent on this chart so there will be a strong pull back to change the trend

which can form to a head and shoulder pattern. For the right shoulder there are 2 keys position to closely monitor.

--------------------------------------------------------------------------------------------------

UsdCad

Cad has just intersect on 4hrs time frame which Cad get stronger above 0 while Usd is just below 0

Cad Strongest in 1hr time frame while Usd 3rd to the weakest currency

The favorable trade will be down however it has already started going down very strong which break the 200MA we will be looking for a retest or pullback. pull back is going to expect above .382 and .618 . so the key factor on this chart is the

1. red box support

.382 Fibonacci

.618 Fibonacci

Pattern is forming Head and shouler

==============================================================

Need to compare this to other trader and find out if they have seen what i have seen on this cart.