Tools You Need

1. Pattern 1day or 4hrs time frame

2. RSI oversold or overbought

3. Candle Stick Pattern

4. Fibonocci tool

5. Support and Ressistance (Structure)

Skills needed

1. Patience and anticipation

2. able to spot the right entry position

3. able to spot where to end

4. able anticipate sudden changes of direction

5. able to spot support and ressistance

Rules

1. Pattern is formed or about to formed

2. supported by RSI oversold or bouaght

3. add trade on pull back

pic above are the example and for the process watch the video

Friday, April 20, 2018

Saturday, December 9, 2017

market checker codes

//Codes by Chrismoody

study(title="CM_Williams_Vix_Fix_V3_Upper_Text-Plots", shorttitle="Market checker", overlay=true)

//Inputs Tab Criteria.

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Market Check")

sbcc = input(false, title="Show Text Plot if Buttom")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title=" choose what to alert")

sa2 = input(false, title="Market Check?")

sa3 = input(false, title="Confirm Entry?")

sa4 = input(false, title="Aggresive Entry?")

//Williams Vix Fix Formula

wvf = ((highest(close, pd)-low)/(highest(close, pd)))*100

sDev = mult * stdev(wvf, bbl)

midLine = sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

plotshape(sbcc and alert1 ? alert1 : na, title="WVF Is True Text", color=lime, style=shape.arrowup, location=location.belowbar ,text='Buttom', transp=0)

plotshape(sbc and alert2 ? alert2 : na, title="Entry/Rev Text", color=aqua, style=shape.arrowup, location=location.belowbar ,text='Entry/Rev', transp=0)

plotshape(sbcAggr and alert4 ? alert4 : na, title="Early in/Rev Text",color=orange, style=shape.arrowup, location=location.belowbar ,text='Early in/Rev', transp=0)

plotshape(sbcFilt and alert3 ? alert3 : na, title="Confirm Entry/Rev Text", color=fuchsia, style=shape.arrowup, location=location.belowbar ,text='confirm entry/Rev', transp=0)

// Find all Fractals.

// This section based on [RS]Fractal Levels by RicardoSantos

hidefractals = input(false)

hidelevels = input(false)

topfractal = high[2] > high[1] and high[2] > high and high[2] > high[3] and high[2] > high[4]

botfractal = low[2] < low[1] and low[2] < low and low[2] < low[3] and low[2] < low[4]

plotshape(hidefractals ? na : topfractal, color=green, transp=0, style=shape.triangleup, location=location.abovebar, offset=-2, size=size.tiny)

plotshape(hidefractals ? na : botfractal, color=red, transp=0, style=shape.triangledown, location=location.belowbar, offset=-2, size=size.tiny)

topfractals = topfractal ? high[2] : topfractals[1]

botfractals = botfractal ? low[2] : botfractals[1]

topfcolor = topfractals != topfractals[1] ? na : green

botfcolor = botfractals != botfractals[1] ? na : red

plot(hidelevels ? na : topfractals, color=topfcolor, transp=0, linewidth=2)

plot(hidelevels ? na : botfractals, color=botfcolor, transp=0, linewidth=2)

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? lime : gray

//Plots for Williams Vix Fix Histogram and Alerts

plot(sa2 and alert2 ? alert2 : 0, title="Alert If Entry/Rev", style=line, linewidth=2, color=aqua)

plot(sa3 and alert3 ? alert3 : 0, title="Alert Confirm Entry/Rev", style=line, linewidth=2, color=fuchsia)

plot(sa4 and alert4 ? alert4 : 0, title="Alert Early in/Rev", style=line, linewidth=2, color=orange)

matype = input(defval="HullMA", title="Fast MA Type: SMA, EMA, WMA, VWMA, SMMA, DEMA, TEMA, HullMA, TMA, ZEMA ( case sensitive )", type=string)

malength = input(defval=20, title="Moving Average Length", minval=1)

src = input(close,title="Moving average Source")

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = wma(src, len) // Weighted

v4 = vwma(src, len) // Volume Weighted

v5 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v6 = 2 * v2 - ema(v2, len) // Double Exponential

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2) // Zero Lag Exponential

v11 = sma(sma(src,len),len) // Trianglular

// return variant, defaults to SMA if input invalid.

type=="EMA"?v2 : type=="WMA"?v3 : type=="VWMA"?v4 : type=="SMMA"?v5 : type=="DEMA"?v6 : type=="TEMA"?v7 : type=="HullMA"?v8 : type=="ZEMA"?v10 : type=="TMA"?v11 : v1

// Calculate selected MA and get direction of trend from it.

zlema= variant(matype,src,malength)

up = zlema > zlema[1] ? 1 : 0

down = zlema < zlema[1] ? 1 : 0

// This section based on Candlestick Patterns With EMA by rmwaddelljr

//

ufb = input(false, title="Use Fractal S/R Cross Patterns")

udc = input(true, title="Use Dark Cloud Cover Patterns" )

upl = input(true, title="Use Piecing Line Patterns" )

ube = input(true, title="Use Engulfing Candle Patterns" )

ubh = input(true, title="Use Harami Candle Patterns" )

upb = input(true, title="Use Defined PinBar Patterns")

pctP = input(66, minval=1, maxval=99, title="Directional PBars, % of Range of Candle the Long Wick Has To Be")

// This section based on CM_Price-Action-Bars by ChrisMoody

// Change the pin bar calculation, so can be used for market direction.

urpb= input(false, title="Use CM Price Action Reversal Pin Bars")

usb = input(false, title="Use CM Price Action Shaved Bars")

uob = input(false, title="Use CM Price Action Outside Bars")

uib = input(false, title="Use CM Price Action Inside Bars")

pctRP = input(72, minval=1, maxval=99, title="CM Reversal PBars, % of Range of Candle the Long Wick Has To Be")

pctS = input(5, minval=1, maxval=99, title="CM Shaved Bars, % of Range it Has To Close On The Lows or Highs")

pblb =input(6,minval=1,title="CM Reversal Pin Bar Lookback Length")

//

stnd = input(true, title="Alert Only Patterns Following Trend")

//

// Get MACD for Alert Filtering

umacd = input(true,title="Alert Only Patterns Confirmed by MACD")

fastMA = input(title="MACD Fast MA Length", type = integer, defval = 12, minval = 2)

slowMA = input(title="MACD Slow MA Length", type = integer, defval = 26, minval = 7)

signal = input(title="MACD Signal Length",type=integer,defval=9,minval=1)

//

sgb = input(false, title="Check Box To Turn Bars Gray")

salc = input(true, title="Show Alert condition Dot")

//

[currMacd,_,_] = macd(close[0], fastMA, slowMA, signal)

[prevMacd,_,_] = macd(close[1], fastMA, slowMA, signal)

plotColor = currMacd > 0

? currMacd > prevMacd ? green : red

: currMacd < prevMacd ? red : green

// Show alert on this bar?

sbarUp = (not umacd or plotColor==green) and (not stnd or up)

sbarDn = (not umacd or plotColor==red) and (not stnd or down)

//PBar Percentages

pctCp = pctP * .01

//Shaved Bars Percentages

pctCs = pctS * .01

pctSPO = pctCs

//ma50 = sma(close,50)

range = high - low

///Reversal PinBars

pctCRp = pctRP * .01

pctCRPO = 1 - pctCRp

//

//pBarRUp= upb and open<close and open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

//pBarRDn = upb and open>close and open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

pBarRUp = urpb and open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

pBarRDn = urpb and open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

//Shaved Bars filter to the MA50 line

sBarUp = usb and (close >= (high - (range * pctCs))) // and close>ma50

sBarDown = usb and (close <= (low + (range * pctCs))) // and close<ma50

//Inside Bars

insideBarUp = uib and (high < high[1] and low > low[1])

insideBarDn = uib and (high < high[1] and low > low[1])

outsideBarUp= uob and (high > high[1] and low < low[1])

outsideBarDn= uob and (high > high[1] and low < low[1])

// PinBars representing possible change in trend direction

barcolor(pBarRUp ? green : na)

barcolor(pBarRDn ? red : na)

//Shaved Bars

barcolor(sBarDown ? fuchsia : na)

barcolor(sBarUp ? aqua : na)

//Inside and Outside Bars

barcolor((insideBarUp or insideBarDn)? yellow : na )

barcolor((outsideBarUp or outsideBarDn) ? orange : na )

//Long shadow PinBars supporting market direction

///PinBars Long Upper Shadow represent selling pressure

pBarDn = upb and open < high - (range * pctCp) and close < high - (range * pctCp)

plotshape(pBarDn and (not pBarRUp and not pBarRDn), title= "Bearish Pin Bar", color=red, style=shape.arrowdown, text="Bearish\nPinBar")

///PinBars with Long Lower Shadow represent buying pressure

pBarUp = upb and open > low + (range * pctCp) and close > low + (range * pctCp)

plotshape(pBarUp and (not pBarRUp and not pBarRDn), title= "Bullish Pin Bar", location=location.belowbar, color=green, style=shape.arrowup, text="Bullish\nPinBar")

dcc = udc and (close[1]>open[1] and abs(close[1]-open[1])/range[1]>=0.7 and close<open and abs(close-open)/range>=0.7 and open>=close[1] and close>open[1] and close<((open[1]+close[1])/2))

plotshape(dcc, title="Dark Cloud Cover",text='DarkCloud\nCover',color=red, style=shape.arrowdown,location=location.abovebar)

pln= upl and (close[1]<open[1] and abs(open[1]-close[1])/range[1]>=0.7 and close>open and abs(close-open)/range>=0.7 and open<=close[1] and close<open[1] and close>((open[1]+close[1])/2))

plotshape(pln, title="Piercieng Line",text="Piercing\nLine",color=green, style=shape.arrowup,location=location.belowbar)

beh = ubh and (close[1] > open[1] and open > close and open <= close[1] and low >= open[1] and open - close < close[1] - open[1] and (high < high[1] and low > low[1]))

plotshape(beh and not dcc, title= "Bearish Harami", color=red, style=shape.arrowdown, text="Bear\nHarami")

blh = ubh and (open[1] > close[1] and close > open and close <= open[1] and high <= open[1] and close - open < open[1] - close[1] and (high < high[1] and low > low[1]))

plotshape(blh and not pln, title= "Bullish Harami", location=location.belowbar, color=green, style=shape.arrowup, text="Bull\nHarami")

bee = ube and (close[1] > open[1] and close < open and close<=low[1] and open>= close[1])

plotshape(bee, title= "Bearish Engulfing", color=red, style=shape.arrowdown, text="Bearish\nEngulf")

ble = ube and (close[1] < open[1] and close > open and close >= high[1] and open<=close[1])

plotshape(ble, title= "Bullish Engulfing", location=location.belowbar, color=green, style=shape.arrowup, text="Bullish\nEngulf")

blfr = ufb and crossover(close,topfractals)

plotshape(blfr and not ble and not blh and not sBarUp, title= "Bullish Fractal Cross", location=location.belowbar, color=green, style=shape.arrowup, text="Fractal\nCross")

befr = ufb and crossunder(close,botfractals)

plotshape(befr and not bee and not beh and not sBarDown, title= "Bearish Fractal Cross", color=red, style=shape.arrowdown, text="Fractal\nCross")

//

bcolorDn = sbarDn and not(pBarRDn or pBarRUp or sBarDown or insideBarDn or outsideBarDn) and (beh or bee or dcc or befr or pBarDn)

bcolorUp = sbarUp and not(pBarRDn or pBarRUp or sBarUp or insideBarUp or outsideBarUp) and (blh or ble or pln or blfr or pBarUp)

barcolor(bcolorDn ? maroon : na)

barcolor(bcolorUp ? lime : na)

//

barcolor(sgb and close ? gray : na)

//

barAlertDn = (sbarDn and (befr or bee or beh or pBarDn or dcc)) or (sbarDn and (insideBarDn or outsideBarDn or sBarDown)) or pBarRDn

barAlertUp = (sbarUp and (blfr or ble or blh or pBarUp or pln)) or (sbarUp and (insideBarUp or outsideBarUp or sBarUp)) or pBarRUp

barAlert = barAlertDn or barAlertUp

alertcondition(barAlert,title="CDLTRD Alert", message="CDLTRD Bar Alert")

// show only when alert condition is met and bar closed.

plotshape(salc and barAlert[1],title= "Alert Indicator Closed", location=location.bottom, color=barAlertDn[1]?red:green, transp=0, style=shape.circle,offset=-1)

//EOF

Credits to

chrismoody

Ricardosantos

justbyuncle

study(title="CM_Williams_Vix_Fix_V3_Upper_Text-Plots", shorttitle="Market checker", overlay=true)

//Inputs Tab Criteria.

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Market Check")

sbcc = input(false, title="Show Text Plot if Buttom")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title=" choose what to alert")

sa2 = input(false, title="Market Check?")

sa3 = input(false, title="Confirm Entry?")

sa4 = input(false, title="Aggresive Entry?")

//Williams Vix Fix Formula

wvf = ((highest(close, pd)-low)/(highest(close, pd)))*100

sDev = mult * stdev(wvf, bbl)

midLine = sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

plotshape(sbcc and alert1 ? alert1 : na, title="WVF Is True Text", color=lime, style=shape.arrowup, location=location.belowbar ,text='Buttom', transp=0)

plotshape(sbc and alert2 ? alert2 : na, title="Entry/Rev Text", color=aqua, style=shape.arrowup, location=location.belowbar ,text='Entry/Rev', transp=0)

plotshape(sbcAggr and alert4 ? alert4 : na, title="Early in/Rev Text",color=orange, style=shape.arrowup, location=location.belowbar ,text='Early in/Rev', transp=0)

plotshape(sbcFilt and alert3 ? alert3 : na, title="Confirm Entry/Rev Text", color=fuchsia, style=shape.arrowup, location=location.belowbar ,text='confirm entry/Rev', transp=0)

// Find all Fractals.

// This section based on [RS]Fractal Levels by RicardoSantos

hidefractals = input(false)

hidelevels = input(false)

topfractal = high[2] > high[1] and high[2] > high and high[2] > high[3] and high[2] > high[4]

botfractal = low[2] < low[1] and low[2] < low and low[2] < low[3] and low[2] < low[4]

plotshape(hidefractals ? na : topfractal, color=green, transp=0, style=shape.triangleup, location=location.abovebar, offset=-2, size=size.tiny)

plotshape(hidefractals ? na : botfractal, color=red, transp=0, style=shape.triangledown, location=location.belowbar, offset=-2, size=size.tiny)

topfractals = topfractal ? high[2] : topfractals[1]

botfractals = botfractal ? low[2] : botfractals[1]

topfcolor = topfractals != topfractals[1] ? na : green

botfcolor = botfractals != botfractals[1] ? na : red

plot(hidelevels ? na : topfractals, color=topfcolor, transp=0, linewidth=2)

plot(hidelevels ? na : botfractals, color=botfcolor, transp=0, linewidth=2)

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? lime : gray

//Plots for Williams Vix Fix Histogram and Alerts

plot(sa2 and alert2 ? alert2 : 0, title="Alert If Entry/Rev", style=line, linewidth=2, color=aqua)

plot(sa3 and alert3 ? alert3 : 0, title="Alert Confirm Entry/Rev", style=line, linewidth=2, color=fuchsia)

plot(sa4 and alert4 ? alert4 : 0, title="Alert Early in/Rev", style=line, linewidth=2, color=orange)

matype = input(defval="HullMA", title="Fast MA Type: SMA, EMA, WMA, VWMA, SMMA, DEMA, TEMA, HullMA, TMA, ZEMA ( case sensitive )", type=string)

malength = input(defval=20, title="Moving Average Length", minval=1)

src = input(close,title="Moving average Source")

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = wma(src, len) // Weighted

v4 = vwma(src, len) // Volume Weighted

v5 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v6 = 2 * v2 - ema(v2, len) // Double Exponential

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2) // Zero Lag Exponential

v11 = sma(sma(src,len),len) // Trianglular

// return variant, defaults to SMA if input invalid.

type=="EMA"?v2 : type=="WMA"?v3 : type=="VWMA"?v4 : type=="SMMA"?v5 : type=="DEMA"?v6 : type=="TEMA"?v7 : type=="HullMA"?v8 : type=="ZEMA"?v10 : type=="TMA"?v11 : v1

// Calculate selected MA and get direction of trend from it.

zlema= variant(matype,src,malength)

up = zlema > zlema[1] ? 1 : 0

down = zlema < zlema[1] ? 1 : 0

// This section based on Candlestick Patterns With EMA by rmwaddelljr

//

ufb = input(false, title="Use Fractal S/R Cross Patterns")

udc = input(true, title="Use Dark Cloud Cover Patterns" )

upl = input(true, title="Use Piecing Line Patterns" )

ube = input(true, title="Use Engulfing Candle Patterns" )

ubh = input(true, title="Use Harami Candle Patterns" )

upb = input(true, title="Use Defined PinBar Patterns")

pctP = input(66, minval=1, maxval=99, title="Directional PBars, % of Range of Candle the Long Wick Has To Be")

// This section based on CM_Price-Action-Bars by ChrisMoody

// Change the pin bar calculation, so can be used for market direction.

urpb= input(false, title="Use CM Price Action Reversal Pin Bars")

usb = input(false, title="Use CM Price Action Shaved Bars")

uob = input(false, title="Use CM Price Action Outside Bars")

uib = input(false, title="Use CM Price Action Inside Bars")

pctRP = input(72, minval=1, maxval=99, title="CM Reversal PBars, % of Range of Candle the Long Wick Has To Be")

pctS = input(5, minval=1, maxval=99, title="CM Shaved Bars, % of Range it Has To Close On The Lows or Highs")

pblb =input(6,minval=1,title="CM Reversal Pin Bar Lookback Length")

//

stnd = input(true, title="Alert Only Patterns Following Trend")

//

// Get MACD for Alert Filtering

umacd = input(true,title="Alert Only Patterns Confirmed by MACD")

fastMA = input(title="MACD Fast MA Length", type = integer, defval = 12, minval = 2)

slowMA = input(title="MACD Slow MA Length", type = integer, defval = 26, minval = 7)

signal = input(title="MACD Signal Length",type=integer,defval=9,minval=1)

//

sgb = input(false, title="Check Box To Turn Bars Gray")

salc = input(true, title="Show Alert condition Dot")

//

[currMacd,_,_] = macd(close[0], fastMA, slowMA, signal)

[prevMacd,_,_] = macd(close[1], fastMA, slowMA, signal)

plotColor = currMacd > 0

? currMacd > prevMacd ? green : red

: currMacd < prevMacd ? red : green

// Show alert on this bar?

sbarUp = (not umacd or plotColor==green) and (not stnd or up)

sbarDn = (not umacd or plotColor==red) and (not stnd or down)

//PBar Percentages

pctCp = pctP * .01

//Shaved Bars Percentages

pctCs = pctS * .01

pctSPO = pctCs

//ma50 = sma(close,50)

range = high - low

///Reversal PinBars

pctCRp = pctRP * .01

pctCRPO = 1 - pctCRp

//

//pBarRUp= upb and open<close and open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

//pBarRDn = upb and open>close and open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

pBarRUp = urpb and open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

pBarRDn = urpb and open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

//Shaved Bars filter to the MA50 line

sBarUp = usb and (close >= (high - (range * pctCs))) // and close>ma50

sBarDown = usb and (close <= (low + (range * pctCs))) // and close<ma50

//Inside Bars

insideBarUp = uib and (high < high[1] and low > low[1])

insideBarDn = uib and (high < high[1] and low > low[1])

outsideBarUp= uob and (high > high[1] and low < low[1])

outsideBarDn= uob and (high > high[1] and low < low[1])

// PinBars representing possible change in trend direction

barcolor(pBarRUp ? green : na)

barcolor(pBarRDn ? red : na)

//Shaved Bars

barcolor(sBarDown ? fuchsia : na)

barcolor(sBarUp ? aqua : na)

//Inside and Outside Bars

barcolor((insideBarUp or insideBarDn)? yellow : na )

barcolor((outsideBarUp or outsideBarDn) ? orange : na )

//Long shadow PinBars supporting market direction

///PinBars Long Upper Shadow represent selling pressure

pBarDn = upb and open < high - (range * pctCp) and close < high - (range * pctCp)

plotshape(pBarDn and (not pBarRUp and not pBarRDn), title= "Bearish Pin Bar", color=red, style=shape.arrowdown, text="Bearish\nPinBar")

///PinBars with Long Lower Shadow represent buying pressure

pBarUp = upb and open > low + (range * pctCp) and close > low + (range * pctCp)

plotshape(pBarUp and (not pBarRUp and not pBarRDn), title= "Bullish Pin Bar", location=location.belowbar, color=green, style=shape.arrowup, text="Bullish\nPinBar")

dcc = udc and (close[1]>open[1] and abs(close[1]-open[1])/range[1]>=0.7 and close<open and abs(close-open)/range>=0.7 and open>=close[1] and close>open[1] and close<((open[1]+close[1])/2))

plotshape(dcc, title="Dark Cloud Cover",text='DarkCloud\nCover',color=red, style=shape.arrowdown,location=location.abovebar)

pln= upl and (close[1]<open[1] and abs(open[1]-close[1])/range[1]>=0.7 and close>open and abs(close-open)/range>=0.7 and open<=close[1] and close<open[1] and close>((open[1]+close[1])/2))

plotshape(pln, title="Piercieng Line",text="Piercing\nLine",color=green, style=shape.arrowup,location=location.belowbar)

beh = ubh and (close[1] > open[1] and open > close and open <= close[1] and low >= open[1] and open - close < close[1] - open[1] and (high < high[1] and low > low[1]))

plotshape(beh and not dcc, title= "Bearish Harami", color=red, style=shape.arrowdown, text="Bear\nHarami")

blh = ubh and (open[1] > close[1] and close > open and close <= open[1] and high <= open[1] and close - open < open[1] - close[1] and (high < high[1] and low > low[1]))

plotshape(blh and not pln, title= "Bullish Harami", location=location.belowbar, color=green, style=shape.arrowup, text="Bull\nHarami")

bee = ube and (close[1] > open[1] and close < open and close<=low[1] and open>= close[1])

plotshape(bee, title= "Bearish Engulfing", color=red, style=shape.arrowdown, text="Bearish\nEngulf")

ble = ube and (close[1] < open[1] and close > open and close >= high[1] and open<=close[1])

plotshape(ble, title= "Bullish Engulfing", location=location.belowbar, color=green, style=shape.arrowup, text="Bullish\nEngulf")

blfr = ufb and crossover(close,topfractals)

plotshape(blfr and not ble and not blh and not sBarUp, title= "Bullish Fractal Cross", location=location.belowbar, color=green, style=shape.arrowup, text="Fractal\nCross")

befr = ufb and crossunder(close,botfractals)

plotshape(befr and not bee and not beh and not sBarDown, title= "Bearish Fractal Cross", color=red, style=shape.arrowdown, text="Fractal\nCross")

//

bcolorDn = sbarDn and not(pBarRDn or pBarRUp or sBarDown or insideBarDn or outsideBarDn) and (beh or bee or dcc or befr or pBarDn)

bcolorUp = sbarUp and not(pBarRDn or pBarRUp or sBarUp or insideBarUp or outsideBarUp) and (blh or ble or pln or blfr or pBarUp)

barcolor(bcolorDn ? maroon : na)

barcolor(bcolorUp ? lime : na)

//

barcolor(sgb and close ? gray : na)

//

barAlertDn = (sbarDn and (befr or bee or beh or pBarDn or dcc)) or (sbarDn and (insideBarDn or outsideBarDn or sBarDown)) or pBarRDn

barAlertUp = (sbarUp and (blfr or ble or blh or pBarUp or pln)) or (sbarUp and (insideBarUp or outsideBarUp or sBarUp)) or pBarRUp

barAlert = barAlertDn or barAlertUp

alertcondition(barAlert,title="CDLTRD Alert", message="CDLTRD Bar Alert")

// show only when alert condition is met and bar closed.

plotshape(salc and barAlert[1],title= "Alert Indicator Closed", location=location.bottom, color=barAlertDn[1]?red:green, transp=0, style=shape.circle,offset=-1)

//EOF

Credits to

chrismoody

Ricardosantos

justbyuncle

Trade Plan Dec 11-15

Head and shoulders forming but on 1hr a bat pattern with supported direction of 200 ma which is going down. as for currency strength cad is pointing in up direction while euro is about to go down on 4hrs time frame while in 1hr Cad is already the strongest currency

+++++++++++++++++++++++++++++++++++++++++++++++++++++

USDCAD

MA is in the Middle in 1hr while in 4hrs about to go down

Head and shoulders forming better trade on break out or near sellers area, structure has been form High lower high so finding the lower low or equivalent.

++++++++++++++++++++++++++++++++++++++++++++++++++

EURJPY

MA 4hrs is in the middle which currently foring a triangle pattern. however since the fab is exactly .618 so a potential perfect abcd pattern will be forming. Looking forward to start the right shoulder which strongly advice to wait for the rejection

++++++++++++++++++++++++++++++++++++++++++++++++++++++

EurUSD

Divergent Head and shoulders forming

Saturday, December 2, 2017

Dec 4 to 8 market watch

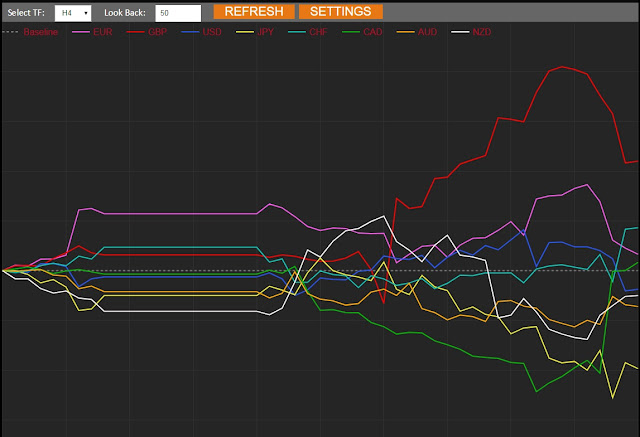

Currency Strength 1hours

Currency Strength 4hrss

EurJpy 4hrs

Euro is strong

Jpy weakest

EurJpy 1hr

Euro is weak below zero

Jpy Weakest

Beautiful pattern have seen in 1hr so trade will be based on 1hr reminder that trend is going up so be cautious on trading down. to trade up it should bounce on the red bar which is the strong support

=========================================================

EurCad 4hr

Eur strong Violet about to cross Cad Grean

EurCad 1hr

Eur weak below zero

Cad Strongest

Currency strength and chart are going in same direction currently Euro is still strong but is about to get weaker. I have seen divergent on this chart so there will be a strong pull back to change the trend

which can form to a head and shoulder pattern. For the right shoulder there are 2 keys position to closely monitor.

--------------------------------------------------------------------------------------------------

UsdCad

Cad has just intersect on 4hrs time frame which Cad get stronger above 0 while Usd is just below 0

Cad Strongest in 1hr time frame while Usd 3rd to the weakest currency

The favorable trade will be down however it has already started going down very strong which break the 200MA we will be looking for a retest or pullback. pull back is going to expect above .382 and .618 . so the key factor on this chart is the

1. red box support

.382 Fibonacci

.618 Fibonacci

Pattern is forming Head and shouler

==============================================================

Need to compare this to other trader and find out if they have seen what i have seen on this cart.

EurCad 4hr

Eur strong Violet about to cross Cad Grean

EurCad 1hr

Eur weak below zero

Cad Strongest

Currency strength and chart are going in same direction currently Euro is still strong but is about to get weaker. I have seen divergent on this chart so there will be a strong pull back to change the trend

which can form to a head and shoulder pattern. For the right shoulder there are 2 keys position to closely monitor.

--------------------------------------------------------------------------------------------------

UsdCad

Cad has just intersect on 4hrs time frame which Cad get stronger above 0 while Usd is just below 0

Cad Strongest in 1hr time frame while Usd 3rd to the weakest currency

The favorable trade will be down however it has already started going down very strong which break the 200MA we will be looking for a retest or pullback. pull back is going to expect above .382 and .618 . so the key factor on this chart is the

1. red box support

.382 Fibonacci

.618 Fibonacci

Pattern is forming Head and shouler

==============================================================

Need to compare this to other trader and find out if they have seen what i have seen on this cart.

Subscribe to:

Comments (Atom)